OMG it’s December already! Time to get your shopping list under control, your Christmas cookie consumption in check, and a solid handle on your health benefits options as the end of the year approaches.

You may be wondering about massage coverage under your insurance insurance plan—specifically, paying for your massage with a Health Savings Account (HSA) or Flexible Spending Account (FSA). It’s actually extremely common, as there are countless health benefits of massage therapy. Massages can improve circulation, decrease pain and inflammation, reduce stress, as well as provide numerous benefits to your heart.

Let’s dive into the world of healthcare to explain how you can pay for massage therapy through your health insurance plan with pre-tax dollars.

HSA and FSA: What Are They?

Before we discuss the process of getting a massage with your insurance plan, let’s do a quick overview on HSAs and FSAs. These are both special healthcare arrangements that allow you to set aside money for medical costs, such as deductibles, monthly prescriptions, copayments, and coinsurance. You don’t pay taxes on this money.

For a detailed list of what costs are considered “medical expenses,” start with this fact sheet from the IRS. In some cases, your employer will contribute money to your HSA or FSA each year as well. Both of these plans have a lot of fine print you’ll need to consider, so talk to your HR department if you have questions.

These healthcare plans usually come with a debit card that includes your (and your employer’s) contributions. In most cases, you won’t have to worry about being reimbursed, as your funds will already be on the flex debit card. You can spend this on any of the above medical costs.

Why Would You Want an HSA or FSA?

There are a wide variety of benefits to these health accounts. First, HSAs and FSAs help you automate your savings for medical expenses. People rarely expect a medical emergency to happen, so these plans help you prepare without having to think about it.

And then there are the tax benefits. For both HSA and FSA, any contributions you make are pre-tax, so you end up saving a lot of money in the long run.

HSAs also roll over, meaning you can take any savings you’ve made for the year and apply them to the next year. FSAs, on the other hand, do not roll over. The set amount you put aside will go away if it’s not spent before December 31.

There are a few differences between FSA and HSA overall, but as it pertains to paying for a massage, they work the same.

Can I use an HSA or FSA for Massage?

In many cases, a massage will be covered by your insurance plan, whether you use an HSA or FSA. Follow these steps to make sure you’re qualified.

1. Start with HR

Before you do anything else, reach out to your HR department or your medical insurance carrier and ask if massage therapy is considered a covered treatment. In some situations, an insurance policy won’t cover massages, even if you get a prescription from a doctor.

That said, at Zeel we’ve found that the majority of customers who have an FSA or HSA had no trouble covering their massages.

2. Doctor visit

Once you’ve gotten the go-ahead from your insurance carrier, schedule an appointment with your primary care physician. Pro tip for this step of the process: Don’t start by just saying you want a massage. You’ll need to first explain your specific symptoms.

There are a wide variety of mental and physical conditions that could qualify for a massage. Stress-related symptoms, circulation issues caused by diabetes or hypertension, sciatica, arthritis, tinnitus, fibromyalgia, anxiety, depression and chronic back pain are all examples that could qualify for massage therapy.

Preparation is key to this discussion. Don’t be afraid to bring case studies of people who’ve alleviated similar symptoms through the power of massage therapy. You could also suggest specific massage therapy options, which can help you illustrate the legitimacy of this type of care.

3. Get a prescription

Once you and your doctor have talked it over, you’ll need them to write a prescription for a massage. In your insurance’s eyes, this acts as proof that you actually need an HSA or FSA massage.

Your prescription will need to include the following:

- A reason you need massage therapy, such as a medical condition or injury.

- The number of sessions you’ll require each month. Do you need a massage every month? Or once every 1-2 weeks? For regular massages, you should consider getting a massage membership to lower the cost of each session.

- The duration of the treatment. How long are you going to need this treatment? Should they be 60-minute, 75-minute or 90-minute massages? Your doctor will be able to guide you in the right direction on this one. You can also change the length, time of day, and cadence as needed.

Getting a prescription is easier than it sounds, so there’s no need to stress. Healthcare providers often write prescriptions for things like massage or acupuncture without requiring an in-person doctor visit. Your prescription can practically be as on-demand as your massage.

4. Use Your FSA or HSA for Massage

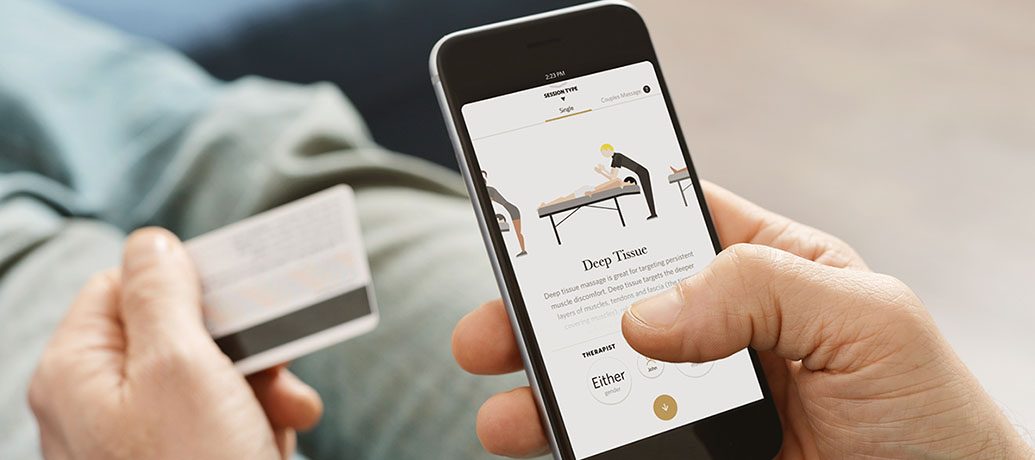

Once you have your prescription, you’ll need to book an appointment with a massage therapy provider, such as one of the 9,000+ licensed therapists in the Zeel network. Luckily, this can be done on-the-fly with the Zeel mobile app or planned ahead up to 30 days in advance. In order to pay for your massage, you’ll just need to have your HSA or FSA debit card attached to your Zeel account. Put these dollars to work for you!

Since the funds on your FSA plan expire at the end of the year, make sure you get the most of your benefits before time runs out. If you’re interested in getting an FSA massage, schedule a time to meet with a primary physician before the year is up. This way, you’ll be able to get the biggest bang from your insurance bucks.

How much will FSA save me?

So how much can you save on a massage by using an FSA? Using an FSA for massage therapy can save you 30-40% a year on out-of-pocket expenses. And if you really want to save big, signing up for a monthly massage membership (which reduces the cost by as much as 30%) could increase your savings even more.

The FSA savings on a year of monthly Zeel massages in Chicago*, for example, would be $429.71 off for non-members (saves 30%) and $625.87 off for members (nearly 45% off the total price). That’s a lot of savings! Zeel is available throughout the U.S. Check out our list of available locations where our network of therapists deliver massage near you.

If you want to see the full scope of savings with an FSA, take a look at this handy calculator to learn more.

*Chicago example based on median household income of $63,153.

Things to keep in mind

When requesting a massage therapy prescription from a doctor, make sure you’re coming at it with the right intentions. The purpose of your health insurance is to cover medical expenses, and massage therapy can be a great way to benefit your health. Be honest when speaking with your doctor regarding your symptoms and why you think massage would be a beneficial therapy.

And for the sake of your financial health, make sure you only use your HSA or FSA for massage therapy expenses if you have a prescription from your doctor. It’s also important that you keep track of your records for tax time. Zeel makes this easy by itemizing every receipt – you’ll have a copy sent to your inbox after every massage. We’ve got your back!

Getting the most from your insurance

When it comes down to it, your insurance is there to keep you healthy. A massage can be a good remedy for many types of injuries and conditions. Take these steps to pay for medical massage with your FSA or HSA plan.

Marcy is the SVP of People and Communications at Zeel. In addition to overseeing the humans of Zeel, Marcy has written about workplace topics for more than 20 years both at Zeel and as VP of Content for Vault.com, a career information web site and publisher.